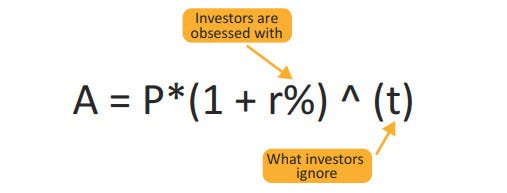

We are living at a time when investing in different asset classes needs to be taken seriously to generate wealth. To generate wealth there are two crucial factors determining its fate, namely - Rate at which the investment grows and Time for which we remain invested. The compounding effect to money takes place when these two factors are focused on optimally.

Most of retail investors expends too much of time and energy to the rate factor which largely is beyond our control as the market is an interplay of human sentiments ranging from greed to fear and hence is unpredictable. The factor that is very much in our control is - Time.

image source : MOSL

If you look closely, successful investors have all been disciplined about one thing and that is staying invested for a longer duration of time. For, ex - Warren Buffet considers age 11 as too late to start investing which speaks volumes about his importance that he attaches to investment duration.

For a decent portfolio generating approx.14-15% of return annually can compound to generate huge amount of wealth if given enough time for it to compound at the portfolio level.